Part 6 CAPITAL ALLOWANCES. Income Tax Act 1967.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax Assessment Act 1936 and section 108 of the Land and Income Tax Act 1954 of New Zealand which was the prede cessor section to the current anti-avoidance provision.

. Income from other sources. The following income of an assessee shall be classified and computed under the head Income from other sources namely-. I First it sets out the Comptroller of Income Taxs CIT approach to the construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA.

1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with. Recently we have discussed in detail section 33 development rebate of IT Act 1961. The amended provision of section 33A is effective for financial year 2020-21 relevant to the assessment year 2021-22.

Section 33A of IT Act 1961-2020 provides for development allowance. Section 33 Income-tax Act 1961. What is Section 33AB of the Income Tax.

Section 33 of the Income Tax Act and Its Mistrust in Judicial Precedent Derivatives and Financial Instruments Vol. Income Tax Act 2007. Explanatory Notes were introduced in 1999 and accompany all Public Acts except Appropriation Consolidated Fund Finance.

X X X X Extracts X X X X. Involving the old section CEC. Previous Section Alt Roimhe.

Income Tax Act 1947. Comptroller of Income Taxn Winslow J. At the rate applicable thereto under 7 sub-section 1 or sub-section 1A as the case may be- i the sum to be allowed by way of development rebate for that assessment year under sub-section 1 8 or sub-section 1A shall be only such amount as is.

Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified. 33Where a person who is the occupier of land in respect of the occupation of which he is assessed under Schedule B is also the owner or part owner of a stallion which is ordinarily kept on such land profits derived by such person from fees received or. As per Section 33AB of the Income Tax Act if a business owner engages in manufacturing and cultivating coffee tea and rubber they are eligible for tax deductions.

98369 471c renumbered section 32 of this title as this section. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by. 98369 474j amended section generally striking out and on tax-free covenant bonds after foreign corporations in section catchline and in text substituting as a credit against the tax imposed by this subtitle for as credits against the tax imposed by.

Tax on income of individuals and Hindu undivided family. 01 Feb 1996 Amended by. The words or section 280-O omitted by the Finance Act 1988 w.

C income from letting of machinery plants or furniture belonging to the assessee and also of buildings. To avail of tax benefits business owners need to deposit the requisite amount in a specified Deposit Account or Special Account. 1a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of.

In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the. Section 331 of the Income Tax Act 1967 ITA reads as follows. The Income Tax Department NEVER asks for your PIN numbers.

Due to be allowed in respect of the assets aforesaid for that assessment year the following procedure shall be followed namely--. B royalties and fees for technical services. A dividend and interest.

Section 33 in The Income- Tax Act 1995. Income Tax Act 1967. FY 2076-77 Fines and Penalties under Income Tax Act FY 2076-77 Income Tax Rates FY 2076-77 Tax Deduction at Source TDS Rates FY 2075-76 Income Tax Rates FY 2075-76 Procedures.

Section 33 - Development rebate - Income-tax Act 1961. Section 331 of the Income Tax Act 1967 ITA reads as follows. Income Tax Trading and Other Income Act 2005.

13 Oct 1995 Amended by Act 32 of 1995. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified.

And ii Second it provides some examples on arrangements which in CITs view have the purpose or effect of tax avoidance within the meaning of section. Explanatory Notes were introduced in 1999 and accompany all Public Acts except Appropriation. Act Nepal provides in depth comprehensive content with many tools summaries a forum for acts rules regulations in Nepal.

Part 4 EXEMPTION FROM INCOME TAX Part 5 DEDUCTIONS AGAINST INCOME. Current version as at 31 May 2022. Today we learn the provisions of section 33A of Income-tax Act 1961.

Amendment of section 33. Section 331 of the Income Tax Act 1967 ITA reads as follows. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and.

Tax Avoidance Section 33 Income Tax Act Singapore. Income Tax Department Tax Laws Rules Acts Income-tax Act 1961.

Pin By Tji Truejobs India On Truejobs India In 2020 Account Executive Income Tax Candidate

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Our Comprehensive Income Tax Knowledge Book Available At A Nominal Annual Subscription Fee Of Rs 999 Here Are The Unique Fe Income Tax Infographic Tax Rules

A Board About Income Tax Preparation Income Tax Preparation Income Tax Tax Preparation

Alert Companies Have Started Issuing Form 16 To File Your Taxes Have You Received Yours Click On The Image To Know Why You Ne Income Tax Income Employment

The Income Tax A Study Of The History Theory And Practice Of Income Taxation At Home And Abroad Seligman Edwin Robert Anderson 1861 1939 Free Download Income Tax Income Theories

12a And 80g Renewal Society Trust Renew

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Al Capone S Tax Returns Tax Return Income Tax Return Tax

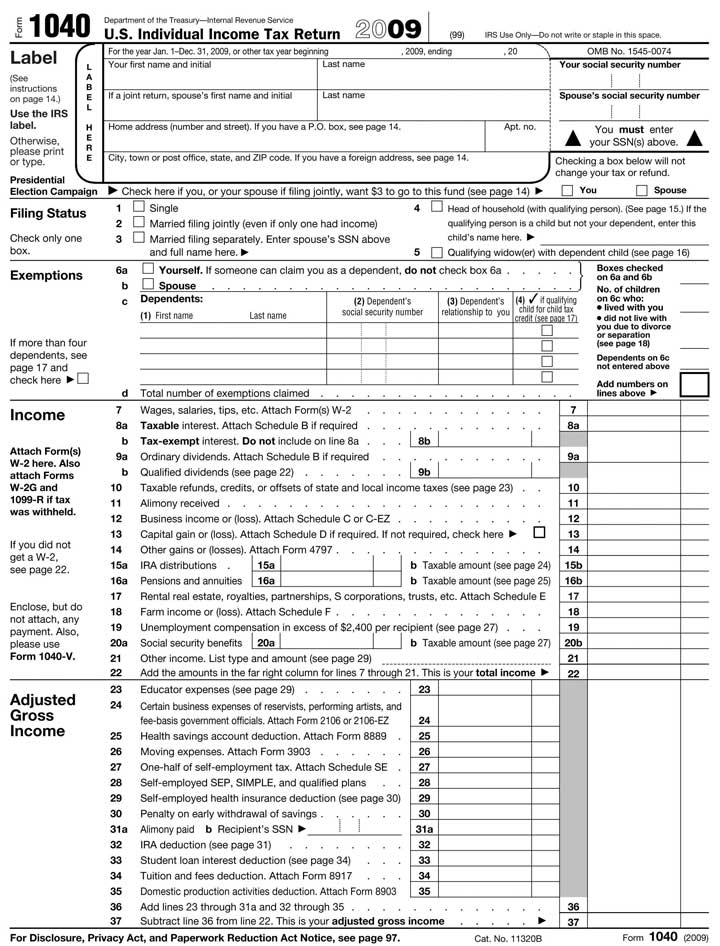

The U S Federal Income Tax Process

Tax Exemptions Deductions And Credits Explained Taxact Blog

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

Pin By Vipin Kumar On Vipin Kumar Coding Qr Code Enhancement

Best Respond To Tax Notice At Kolkata Filing Taxes Bookkeeping Services Income Tax Return

About Us Taxovita Com Income Tax Return Income Tax Return Filing Income Tax